Introduction:

Costco Wholesale Corporation (NASDAQ: COST) is one of the most successful retail giants in the world. Known for its membership-based warehouse model, Costco has built a loyal customer base and demonstrated strong financial performance. Investors have been drawn to Costco stock due to its consistent growth, impressive revenue, and resilience even in economic downturns.

However, as with any investment, there are both opportunities and risks associated with Costco stock. This article provides an in-depth analysis of Costco’s stock performance, financial health, market position, growth potential, and potential risks.

Costco’s Business Model and Competitive Advantage

Costco stock operates on a unique warehouse club model, offering bulk products at competitive prices to its members. The company generates significant revenue through membership fees, providing a steady income stream regardless of retail sales fluctuations. This model differentiates Costco from traditional retailers and contributes to its high customer retention rate.

Several factors contribute to Costco’s competitive advantage:

Membership Revenue: Membership fees contribute significantly to profits, allowing Costco to keep product margins low while maintaining profitability.

Bulk Purchasing Power: Costco negotiates favorable pricing with suppliers due to its bulk purchasing model, which helps in cost-cutting.

Customer Loyalty: High renewal rates for memberships show strong brand loyalty among consumers.

Limited SKU Strategy: Unlike traditional supermarkets, Costco offers a limited selection of products, reducing inventory costs and improving supply chain efficiency.

Financial Performance and Stock Growth

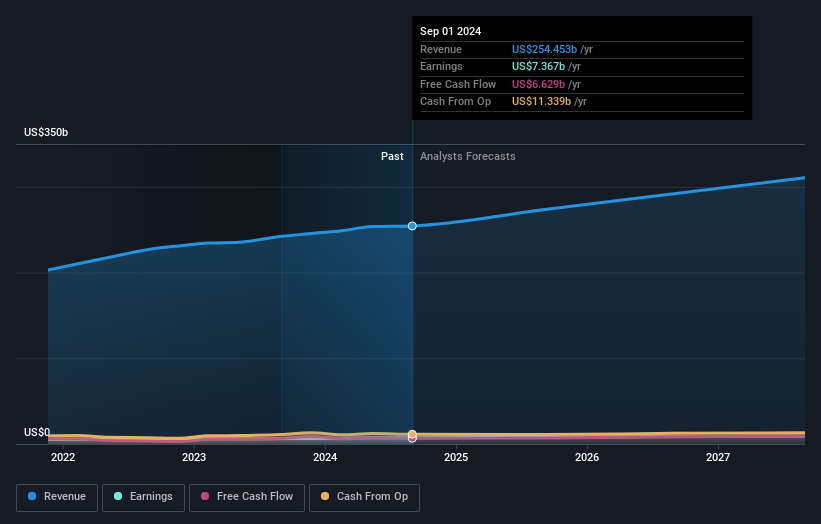

Costco’s stock has consistently outperformed the market over the years. The company has shown strong revenue growth, stable profit margins, and an expanding membership base. Below are the key financial highlights:

Revenue Growth

Costco stock has consistently reported year-over-year revenue growth. The company benefits from increasing consumer spending and expansion into new markets. E-commerce sales have also played a role in revenue growth, especially following shifts in consumer behavior due to digital transformation.

Profitability and Margins

Costco operates with relatively low margins due to its bulk pricing strategy. However, its profitability remains strong due to its ability to drive high sales volume. Membership fees provide a recurring revenue stream that enhances profitability.

Dividend and Shareholder Value

Costco has a history of paying dividends, which is attractive to long-term investors. The company has also issued special dividends in the past, rewarding shareholders with additional returns.

Market Position and Competitive Landscape

Costco competes with major retailers such as Walmart (Sam’s Club), Target, and Amazon. However, its membership-based model gives it an edge. The company continues to expand internationally, further solidifying its market presence.

Expansion Strategies

Costco has been expanding its store footprint, particularly in international markets such as China, Canada, and Europe. As the company continues to grow, international sales are expected to contribute more significantly to overall revenue.

Growth Potential and Investment Outlook

Several factors indicate continued growth potential for Costco stock:

E-commerce Growth: Online shopping is a major driver of retail growth, and Costco has been investing in its digital platform to enhance its online presence.

New Store Openings: Costco is strategically opening new warehouses in high-demand areas, contributing to revenue expansion.

Membership Base Growth: Increasing membership numbers will continue to provide a steady revenue stream.

Private Label Success: Costco’s private label, Kirkland Signature, remains a major contributor to profitability due to its high margins and customer preference.

Potential Risks for Investors

While Costco stock presents strong growth prospects, investors should also consider potential risks:

Economic Slowdowns: A downturn in the economy could impact consumer spending and discretionary purchases.

Competition: Rival retailers, including Amazon and Walmart, continuously enhance their offerings, increasing market competition.

Cost Pressures: Rising labor costs, supply chain disruptions, and inflation could impact profit margins.

Stock Valuation: Costco stock often trades at a premium valuation compared to its peers. Investors must assess whether the stock price justifies its growth potential.

Conclusion: Is Costco Stock a Good Investment?

Costco stock has proven to be a strong, resilient company with a solid financial foundation and a loyal customer base. Its business model, membership revenue, and expansion strategies support long-term growth. While there are risks associated with economic downturns and competition, Costco’s fundamentals remain strong. For long-term investors looking for a reliable and well-established company, Costco stock presents an attractive option. However, it is essential to consider valuation and market conditions before making an investment decision.